Reflections on Vancouver, British Columbia and other topics, related or not

Miner confusion,

with a Transylvanian twist

A “Canadian mining” company that’s neither

Canadian nor mining typifies many Canadian “miners”

Greg Klein | May 23, 2024

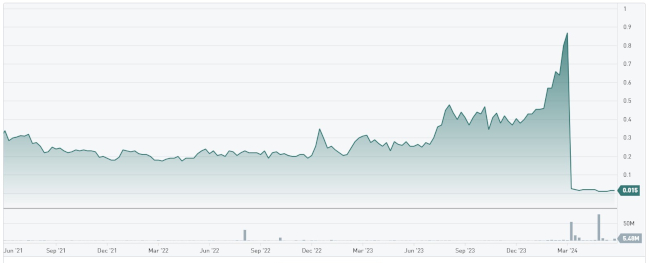

Gabriel Resources’ three-year stock chart to May 23: Irregular but overall

improvement since July 2023 might have been helped by statements

from Romania’s PM and finance minister. The stock spiked,

then plummeted with the “travesty” of March 8.

(Image: TSX Venture)

A recent BBC/CBC podcast series that promises new info about Bre-X Minerals1, the greatest of all Canadian gifts to the world of mining scams, prompts completion of this post which began last March. I didn’t finish it then due to an impending visit to one of the countries in question.

As of March and April, international media interest in Romania focused on sleazebag Muslim convert Andrew Tate and supposed mining company Gabriel Resources. Both took advantage of Romanian corruption and both now face a legal setback. To hell with the misogynist Mohammedan but Gabriel is partly a Canadian story—not, however, in the way international media and their Canadian copycats have claimed.

On March 8 Gabriel lost a crucial decision by the World Bank’s International Centre for Settlement of Investment Disputes. The company had asked for US$4.4 billion because Romania rejected its proposal to build a gold mine at Transylvania’s Rosia Montana. As news outlets stated, it’s another big-money proposal defeated by local opposition and environmental activists. So far, somewhat accurate. But the internationally publicized “failure” of a “Canadian” “miner” belies the fact that the company isn’t Canadian, isn’t a miner and, despite a possibly company-killing setback, might very well have accomplished its goal.

Gabriel’s claim to Canada consists of a listing on the TSX Venture Exchange, the Toronto-based, world-leading venue for domestic and foreign mining-related stocks considered “small cap” (relatively small total value of all outstanding shares). Gabriel is registered in Jersey and keeps its HQ in London, England. An obligatory Canadian address consists of a mail drop on a residential side street in Whitehorse.

Gabriel management show no experience in geology, metallurgy, engineering or other mining-related necessities. They’re all money men. Their expertise involves the weird world of financial freemasonry necessary to defy the laws of financial gravity.

Gabriel’s original boss Frank Timis, a convicted heroin dealer with a notorious reputation as “Emperor of West African Resources,” might, might once have intended to build a mine, relying hopefully on his 1990s relationship with whatever clique was then corrupting Romania. Success would have resumed gold and silver extraction that dates back to antiquity.

Many residents opposed the idea because of its cyanide-based extraction plan, not to mention the requirement that an entire village move to a new location. Around 2002 international activists jumped in, eventually including Vanessa Redgrave and George Soros. In October 2011 the company’s share price began its steep descent from a February high of C$8.41. In 2014, following country-wide protests, the Romanian government abandoned its 20% interest in Gabriel and withdrew its support. In 2021 UNESCO declared Rosia Montana a World Heritage site for its Roman mine workings.

Consequently Gabriel has spent years as a stock that rises or falls according to investors’ perceptions that, with such chancy company prospects, can be especially susceptible to promotional hype. Management, cronies and co-conspirators might receive free or cheap shares and conduct pump-and-dump schemes to artificially jack up the price before suddenly selling off. Insiders win and so, sometimes, do clever observers. Punters lose.*

This 2015 scene shows belated signage

outside the former Vancouver Stock Exchange.

(Photos by Greg Klein, except where indicated)

Such is junior mining. The term usually refers not to actual miners but to exploration companies that look for mineral and metal deposits, to companies that have found a deposit and hope to build a mine or sell to someone who can, and to faux outfits pretending to do any of the above. In the latter case, their reason for existence is to sell shares with little or no intrinsic value. Confusing matters, the hustle sometimes blurs with legitimate efforts to develop a project of actual value. Many world-renowned deposits have been discovered by juniors, even if many other juniors are outright frauds.

All that’s a subject alien to most Canadian media. (See, for example, this May 22 Vancouver Sun/Postmedia ignorance, with its false headline, preposterous delusion that B.C.’s NDP supports mining, and non-mention of Canada’s “native veto,” the tremendous aboriginal power that easily prevents resource and infrastructure development.) Even a business periodical as prominent as the Financial Post misunderstood the Gabriel story. That, despite this country’s supposed status as the world’s greatest mining country.

Dubious as that designation is, Canadian miners and juniors like to repeat it. The title better suits China and Russia. Canada and Australia lead the world in global mineral and metal exploration. But Australia’s prevalence of publicly listed miners has surpassed Canada’s, due to greater presence of major companies. That results from tougher federal restrictions on foreign takeovers as well as a social ethic that encourages nationalism, even among business people.

Yet the TSX Venture still outperforms the Australian Securities Exchange for junior mining stock membership. Vancouver, meanwhile, probably has the world’s largest concentration of junior mining headquarters. That rationalizes the city’s reputation as the mining capital of the world, a legacy of Vancouver’s previous reputation as the scam capital of the world.

Again, a subject alien to most Canadian media. Journalistic ignorance on any topic can be expected from Canada’s pitiful fourth estate. But it’s mainstream media, along with insider bullshit, that can propel a scam from the level of mere hype to outright mania. That was the case with Bre-X, a mid-’90s fraud that stoked euphoria maybe comparable on a Canadian level to the 1630s Dutch Tulip Bubble and Britain’s 1720 South Sea Bubble. The complexity of the 1720s Mississippi Bubble and France’s related financial and economic machinations rates a separate category of madness. Bre-X was simple—a crudely simplistic swindle that relied on the credulousness of stock brokers and stock analysts, as well as journalists in both the mining and mainstream media.

Vancouver-style chicanery, meanwhile, has taken on new forms. Visit any mining investors’ conference and you’ll see lots of crooked old men and stupid old punters. Any pretense to global scam capital status now results from newer endeavours—real estate speculation, money laundering and likely the world’s most outrageous poverty pimp industry.

*Here’s more of the Romanian story…

UNESCO describes Rosia Montana as “the most significant,

extensive and technically diverse underground Roman gold

mining complex currently known.” (Photo: Ivan Rous)

Determining whether Gabriel insiders benefited from stock manipulation would call for details about who sold what, when and for how much. What intel can be found—much of it’s disguised through proxies—would then be checked with coinciding statements issued by the company and other interested parties, and with coinciding company info that later came to light.

Not without controversy, Romanian PM Marcel Ciolacu and his finance minister had said Gabriel might win the arbitration decision. On February 1, five weeks before the tribunal’s announcement, Ciolacu suggested a possible referendum on Gabriel’s proposal, with disclosure of government documents “so the Romanians can know very clearly who was wrong in this case.”

An opposition leader blamed Ciolacu’s statement for Gabriel’s coinciding share price surge from a 50-cent market-open that day to close at C$0.57 the next, an impressive 14% jump. Actually the price had been mostly rising since a July 3, 2023, price of C$0.27. The stock began 2024 on C$0.425, hitting 87 cents by March 8. That day’s arbitration decision smashed Gabriel down to six cents, two cents, then one and a half.

Seemingly undeterred by the arbitrators’ “travesty of justice”—which included a bill for US$10 million in fees and expenses—Gabriel announced it was considering the ICSID annulment process. On May 17 the company announced a private placement (a private sale of newly issued shares) had raised US$3.25 million. At two cents (Canadian) a share, that increased Gabriel’s outstanding shares by about 21.2%, massively diluting any intrinsic value the company might ever achieve. Gabriel plans to offer another placement of up to US$2.325 million.

An artisanal gold miner’s homestead originally from Rosia Montana,

now in an open air museum in Sibiu, Romania. Ore extracted with

hand tools was initially processed (“washed”) in the basement.

Apart from government-opposition arguments about the industry, mine workers themselves have taken active roles in Romanian politics. Probably the biggest anti-Communist demo prior to the Ceausescus’ 1989 ouster-by-firing-squad was a 1977 strike by an estimated 30,000 to 35,000 coal miners in Transylvania’s Jiu Valley. But the region’s miners turned pro-regime during 1990 student protests. Jiu Valley mobs stormed into Bucharest, joining factory workers to wield clubs against anyone suspected of dissent. The “mineriad” (their alleged slogan: “We are workers, not thinkers,” also translated as: “We work, not think”) resumed in 1991, amid accusations that miners were infiltrated by agents of the president, a former Commie apparatchik. (Details remain muddy but the “so-called revolution,” as skeptics call it, may well have been a palace coup, or at least a coup that coincided with popular revolt.)

With Santa Maria di Loreto to the left, Trajan’s Column

still looms over the Roman Fora to show spiralling

bas-reliefs that commemorate victory over the Dacians.

It was mineral wealth that brought Romans to what much later became their near-namesake. A frustrating effort began with defeat by local Dacians, who actually forced the mighty empire to pay tribute. After three years of planning and a failed second invasion, Trajan’s army finally prevailed in AD 102. Four months of festivities and a grant of 650 dinars to each Roman taxpayer celebrated the bloody but auriferious conquest.

A detail from Trajan’s Column on a copy in the

National History Museum of Moldova in Chisinau.

Rome withdrew in 271 but mining continued in various parts of present-day Romania, both on an industrial and artisanal (small, unsophisticated) scale. Intermittent mining at Rosia Montana ended in 2006.

1Update: The BBC/CBC podcasts offer possibly the best account so far of the Bre-X fraud, but focus mostly on new evidence that senior scammer Michael de Guzman didn’t fall or jump from a helicopter, contrary to many 1997 reports that declared him dead. The new evidence helps substantiate this aspect of his scheming, but hardly amounts to a revelation. De Guzman has made enough post-mortem appearances to rival Elvis.